Why project managers & Value engineers get paid more?

A few wind contract listings on the recruiting pages were paying £550 - £600 (USD 669.60 -763.20) per day to acquire a Senior Project Manager who is well-versed in “project cost accounting and a good understanding of capex budgetary structures”. It comes to approximately USD 201136.32 per annum.

Another one was looking for a Value Engineer in England, who can “Provide LCoE analysis to support the optimization of the design of the wind farm – benchmarking, CAPEX, OPEX, energy yield”

I took it upon myself to research what CAPAX, OPEX, LCoE, benchmarking, and energy yield, and this is how I understand them.

Capital Expenditure (CAPEX)

CapEx stands for Capital Expenditure. It is the money a company invests in buying assets, property, plant & equipment (PP&E). It is an important indicator for investors to judge whether a manufacturing company is growing.

There are TWO types of CapEx:

(1) Maintenance CapEx where the capital expenditure required to sustain a company’s current state of growth and profitability, while (2) Expansion CapEx entails the capital expenditure undertaken to grow a company’s operating cash flows (and valuation) beyond that of historical levels.

CapEx

= PP&E (current period) — PP&E (prior period) + Depreciation (current period)

PP&E (Property, plant, and equipment. Fixed assets of real estate, plant and equipment on the balance sheet

Depreciate&Amortization: Depreciation and amortization of Income Statement

Operational Expenditure (OPEX)

OpEx is the company's daily normal expenditure, including employee salaries, rent, utilities, property taxes, and cost of goods sold (COGS), business travel...etc. The rent of rented equipment may be included in OPEX instead of CAPEX. OPEX is also tax-deductible.

If companies are unable to raise product prices or expand new markets to increase revenue, they will often try to save costs to maintain profitability, including reducing OPEX operating expenses. If a company has lost its competitiveness, it may have to save money through layoffs and other means.

OpEx

= selling, general and administrative (SG&A)

= accounting supplies + expenses on office supplies + insurance + licensing fees + legal fees + marketing and advertising + payroll and wages + repairs and equipment maintenance + taxes + travel + utilities + vehicle expenses

Unlike CapEx, operating expenses (OpEx) are shorter-term expenses used for the day-to-day operations of a business.

Energy Yield (EY)

Energy yield is typically in kWh/kWp values, which refers to how much energy (kWh) is produced for every kWp of module capacity over a typical or actual year.

The actual yield is driven by many factors, including location, weather file, module orientation, module selection, and Balance of system efficiency.It’s used to compare different locations, to analyze different designs or to assess the health of an array.

Every green infrastructure has its own formula of calculating yield.

Levelised COst of Electricity (LCoE)

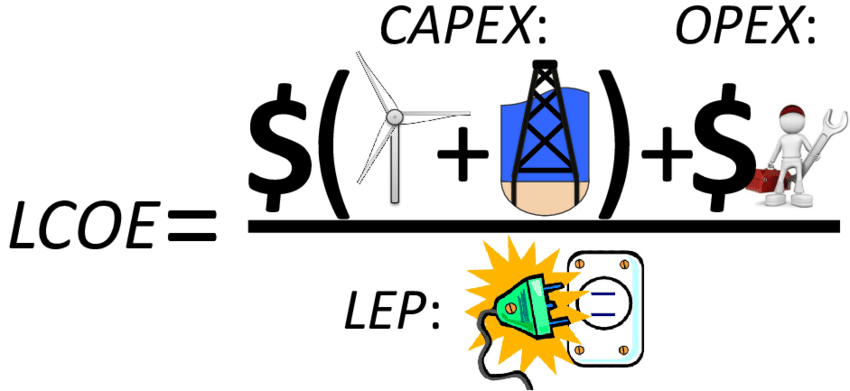

The decision to invest in an energy project depends not just on whether it’s viable, but on the profitability that it’s likely to achieve over its lifespan. The way to determine that is by assessing a few key financial metrics, including the levelized cost of energy (LCOE).

Also known as the levelized cost of electricity or the levelized energy cost (LEC), LCOE calculates the cost not only of building a project but also of operating and maintaining it over time.

The calculation of the Levelized Cost of Energy (LCOE) enables project developers and financiers to compare different generation technologies (like solar, wind, nuclear, gas, and coal) on an equal footing. It considers various factors such as project lifespan, capital costs, fuel costs, capacity size, and risk. LCOE is a useful metric as it enables comparisons between different projects and energy sources to determine which is the most competitive,such as how competitive renewable projects are against fossil fuel generation.

The LCOE is the lifetime cost of an electricity plant, divided by the amount of electricity it is expected to generate over its lifetime.

Initial capital cost: $50,000

Tax credit: $15,000

O&M: $4,000

Total cost: $50,000 - $15,000 +$4,000 = $39,000

Average annual electricity production: 62,500kWh

PV equipment warranty period: 25 years

Total electricity production: 1,562,500kWh

LCOE: $39,000 / 1,562,500 = $0.02496/kWh